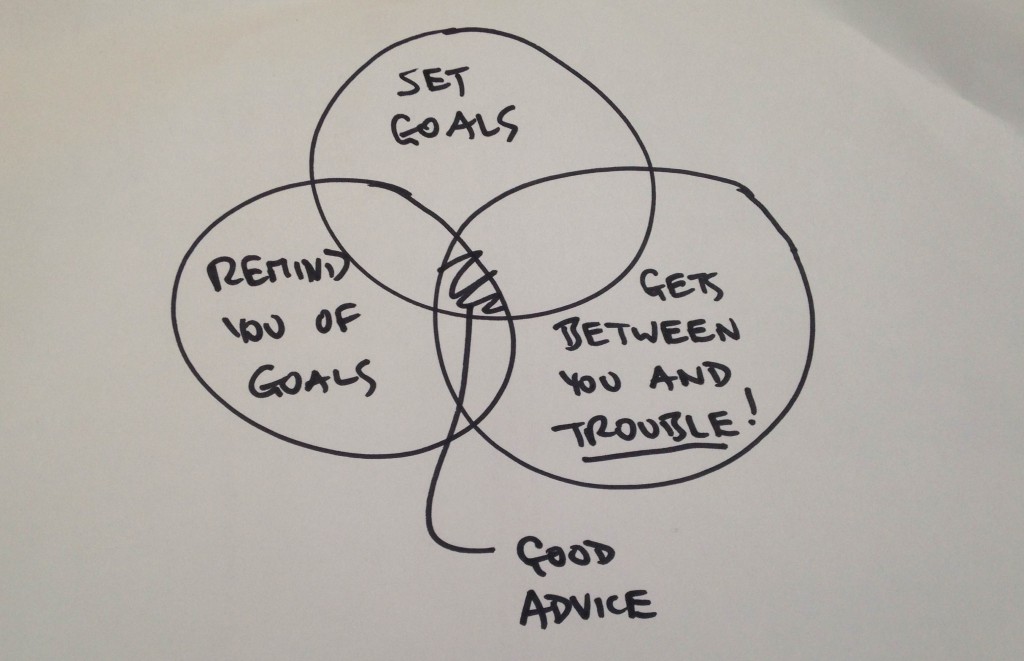

Carl Richards has a great column in the New York times called Sketch Guy where he boils complex financial issues down to simple concepts sketched on the back of a cocktail napkin. We recently saw Carl Richards speak and he talked about how people benefit from working with a financial planner. Here is our attempt at a Carl Richards’ sketch to illustrate his point.

Goal setting is important – if your financial plan is not tied to life goals about which you are passionate, you simply won’t have the motivation and discipline to see it through to fruition. “Getting between you and Trouble” is important because Trouble can manifest itself in many different ways, especially when it comes to implementing the investment part of your financial plan. Trouble might cross your path in the following guises:

Accepting high and hidden fees – Canada has some of the highest mutual fund expenses in the world and the impact on returns is poorly disclosed.

Engaging with those who may not have your best interest in mind – Many Canadians are advised to invest in securities and funds by advisors who are compensated based on selling product, not on providing advice.

Putting all your eggs in one basket – Investors’ holdings may be concentrated in too few investments across too few sectors and regions.

Not properly taking account of risk – There are countless stories of investors suffering loss by holding investments that are totally inappropriate for their risk profile.

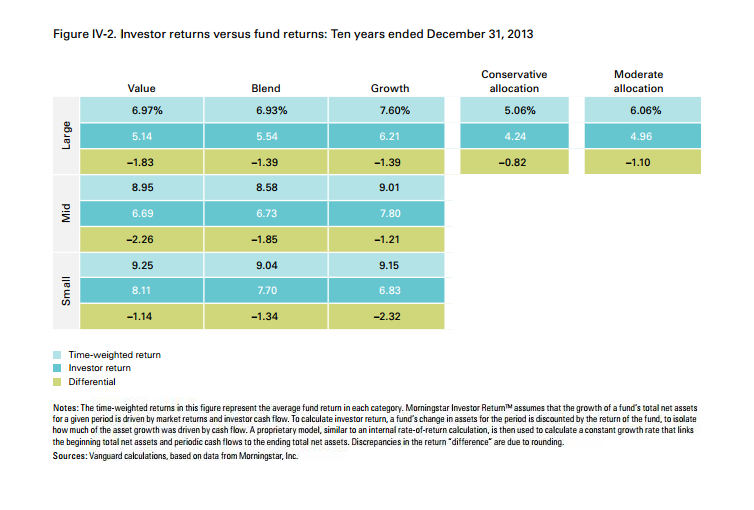

But what happens if the Trouble is you? The evidence suggests that Trouble lurks when individual investors try to “time” their investments. It’s possible to observe the magnitude of the impact by comparing the performance of investment fund returns with the performance of what is termed “dollar-weighted returns”. “Dollar-weighted returns” represents what the average investor actually earns as a result of not only which funds they invest in but when they invest. Investors clearly let themselves down. The following chart from Vanguard using data from Morningstar illustrates that the impact is common across all different types of funds.

The returns experienced by the average investor, represented by the darker blue rows, are lower than actual fund performance in every fund classification and risk class.

Do you try to pick the best fund manager based on past performance? Do you try to time the stock market’s ups and downs and instead find yourself chasing performance? The above evidence suggests your performance may suffer as a result of your own behaviour. So you may want to think about getting something in between you and Trouble, especially if that Trouble is you!