As proud Canadians, nothing gets us going more than a good Canada vs. USA discussion. When you live in the shadow of something so big it’s hard not to be a little defensive sometimes. These days, I’m a little sensitive about hockey – so many taunts coming in from friends south of the border trying to get a reaction by reminding me that not a single Canadian NHL franchise made the playoffs this year! (And so many times have I reminded my taunters to look at their teams’ rosters to check how many Canadian versus American players they have! Ha!)

The taunters always know there is one subject where I have no comeback, however – the investment industry – in particular mutual fund fees and the penetration of passive or evidence-based investing in Canada (yes, a lot of my friends are in the investment industry). The fees Canadians pay for their mutual funds are the highest in the world and generally twice what they are south of the border. At least part of this must be due to the slower adoption of passive or evidence-based investing – passive investment products such as ETFs and low cost mutual funds usually come with expense ratios much lower than their active fund counterparts.

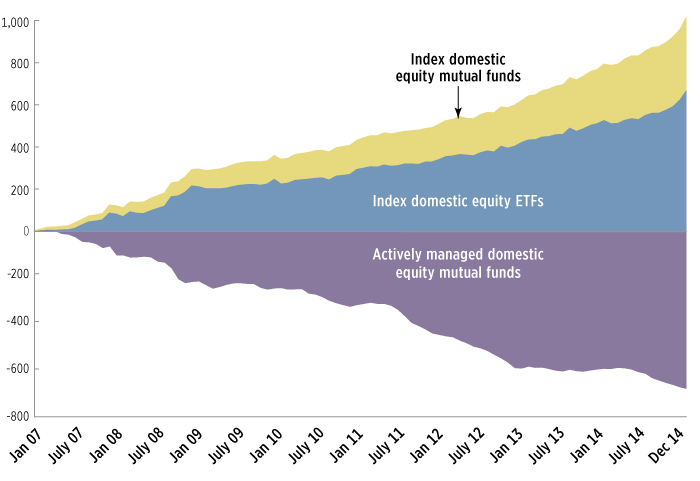

The shift in approach in the US is amazing – an article in Bloomberg yesterday decreed that the “Financial Industry is Having its Napster Moment“. It’s hard not to agree when you look at the data – the picture below is from the article and shows the massive cumulative flows of funds out of US domestic actively managed mutual funds into domestic index equity mutual funds and index ETFs (the scale is in billions).

Morningstar estimates that the market share of passive mutual funds and ETFs in the US grew from about 20% in 2008 to 32% in 2015. In Canada in 2015 passive funds only represented about 12% of the market, up from about 7% in 2008. Growth in market share has all but stopped in Canada since 2013.

This is especially surprising because the benefits of a switch in Canada from active to passive/indexing are much greater! For example, you can establish a sensible globally diversified portfolio of equity, fixed income and real estate investments using ETFs for an all-in management fee of 20 basis points (1/5 of 1%). This is less than 1/10th the fees Canadians pay for an active mutual fund portfolio and the evidence shows quite compellingly that the passive portfolio will outperform the active portfolio, on average, by the fee differential. And of course the kicker is that with the passive portfolio you get market performance with a fair degree of certainty. With active management you run the risk of finding one of many under-performing managers with your odds of picking a winner decreasing over longer time periods.

So why isn’t our financial industry experiencing the same “Napster moment”? I hate to think we don’t care about our finances as much as Americans do. We aren’t lazier! It may be the structure of the industry, regulation, availability of unbiased advice or perhaps a combination of all these things. Whatever the reason, with such a powerful trend that benefits consumers happening just south of the border, it’s hard to imagine that we won’t start seeing the same pattern here.