“In short, these ETFs live by the big stock sword but they also die by the big stock sword.”

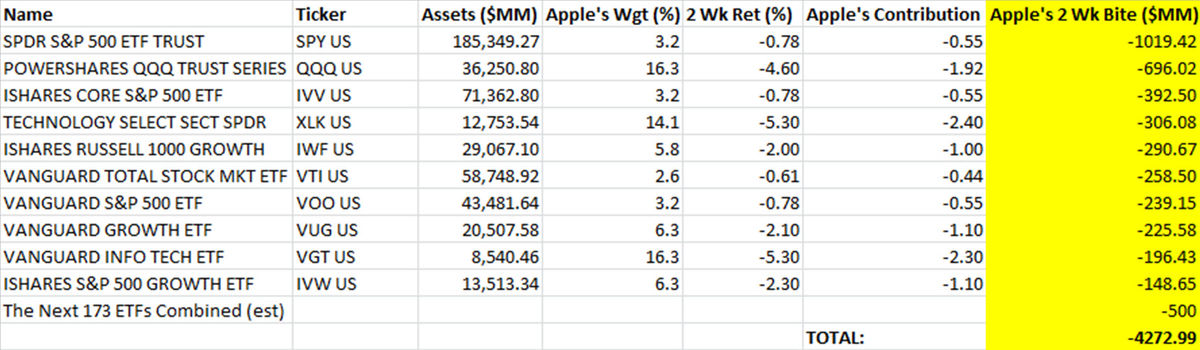

This quote from a Bloomberg article this morning “Apple Takes a $4 Billion Bite Out of ETFs as Smart-Beta Shines”, captures one of the obvious shortcomings of investing in simple exchange traded funds (ETFs) that weight their holdings by the market capitalization of each stock. Apple is an outsized component of many commercial indices like the S&P 500 and therefore also a large component of the ETFs that use such indices as their benchmark. According to the article, ETFs own about 5% of Apple’s outstanding stock and it’s the biggest holding in 5 of the 6 largest ETFs. Its weighting inside ETFs is larger than the entire country of China.

Source: Bloomberg

So when Apple stock underperforms, as it has recently, these indices and ETFs based on them which hold a good slug of Apple shares, also underperform. Market-cap weighted indices serve as the basis for a lot of ETFs and index mutual funds for some good reasons. They are easy to understand, fairly representative of the “market”, inexpensive, objective and are what market commentators talk about when they say the market is going up and down. These reasons, however, don’t necessarily mean indices are the most intelligent way to build a well diversified low cost investment portfolio.

One main criticism of the use of market-cap weighted indices as the basis of an investment portfolio is that it will leave you overweight more expensive stocks. If the market isn’t perfectly efficient all the time, and it probably isn’t, then some stock prices will be higher than the fundamental value of the company and some stocks will be lower. By definition the index will be overweight the stocks priced higher than their fundamental value and underweight those priced lower than their fundamental value.

Academic evidence suggest that using factors other than market-cap to weight an investment portfolio will lead to higher returns. Of course higher returns usually means higher risk, but constructed and managed in the right way, more intelligent indices can lead to higher returns over time, therefore avoiding the “bad Apple” problem.