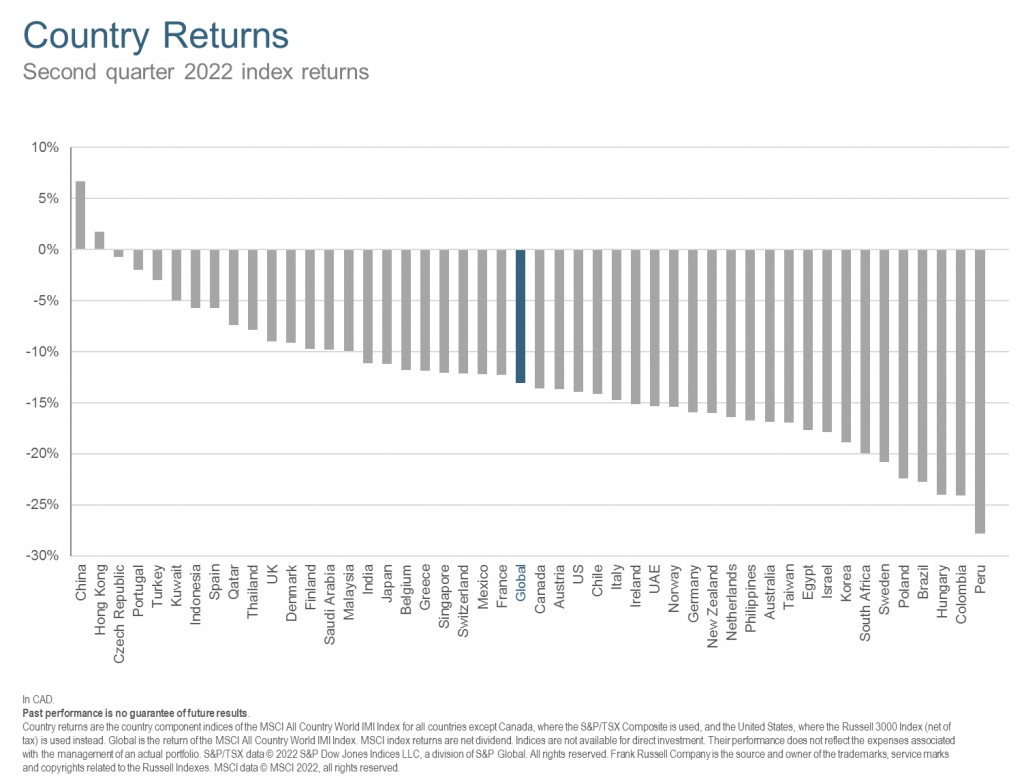

Welcome to the Chalten Investment Review for Q2 2022. Global equity and bond markets continued to decline in the second quarter with investors fearing higher interest rates, potential recession and continued global instability. As the chart below illustrates, in Q2 there were not many countries that escaped negative performance, but performance still varied greatly. It helps to be diversified.

What have we learned that can help us weather this market storm?

As you know, dealing with uncertainty and volatility is part of being an investor – it comes with the territory. Looking at how the market has behaved historically in certain situations sometimes can reveal lessons that could be helpful now. The following two lessons are relevant for the current situation.

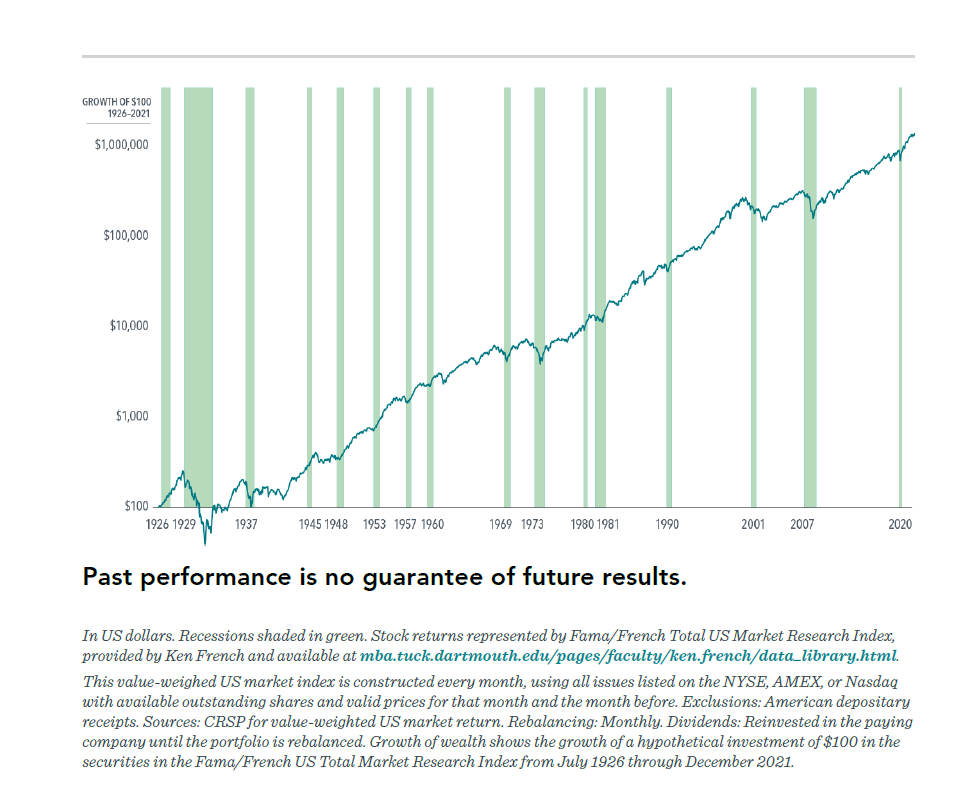

- A recession is not a reason to sell

Official economic data does not often tell us we are officially in a recession until well after the recession has started and sometimes not until after it has ended. Furthermore, market declines sometimes occur in advance of economic recessions and returns can also be positive throughout recessions. See the chart below showing the progression of US stocks (the upward sloping line) vs times when there was a recession (the shaded green areas):

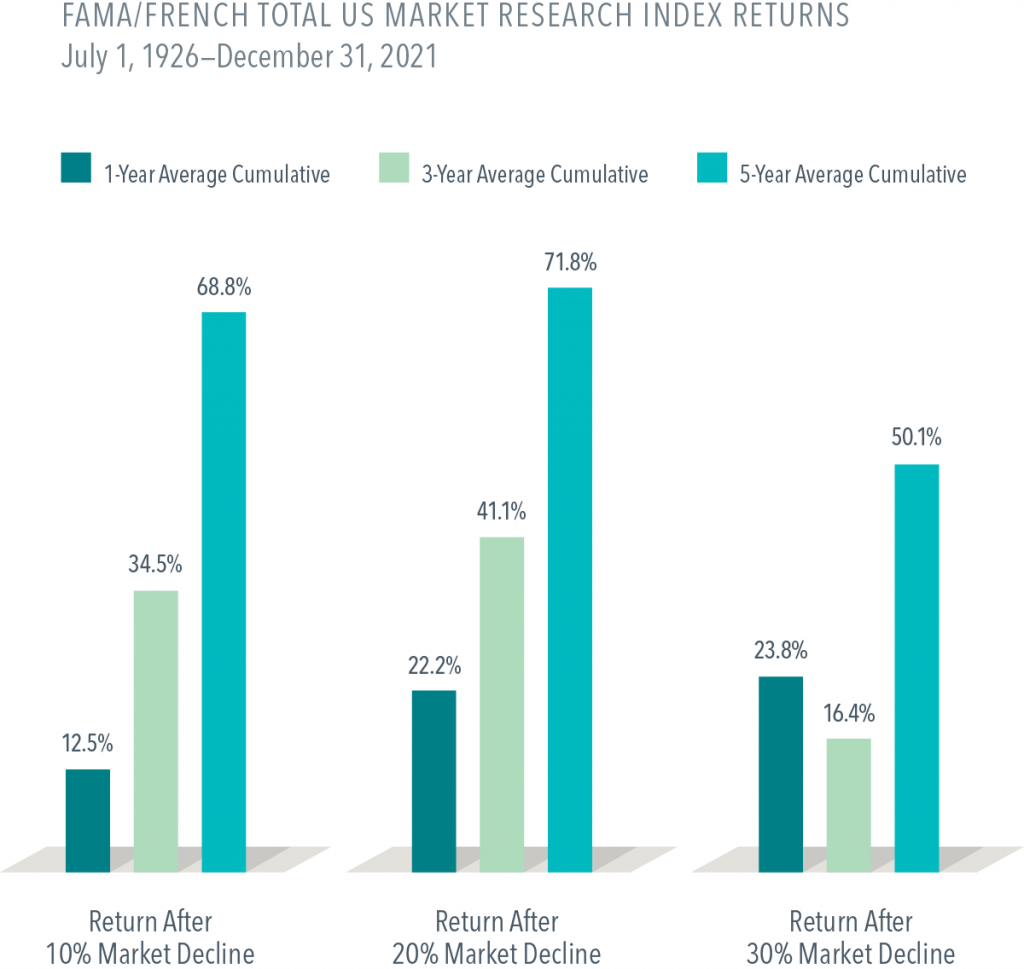

2. Stocks have averaged positive returns over one, three and five year periods following a steep decline

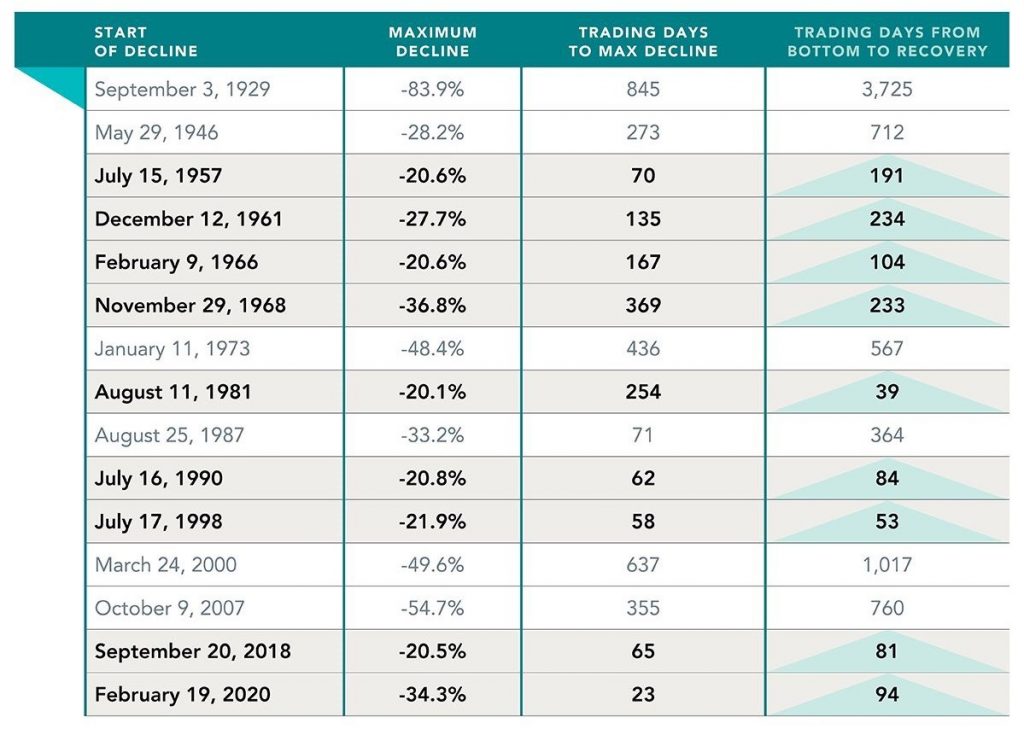

Whether in conjunction with a recession or not, market downturns can be painful to experience. However, downturns can also be followed by strong recovery. The following table lists the 15 US bear markets (greater than 20% fall) since 1926, the severity and length of the downturn and how long it took for the market to fully recover. In 9 of the 15 bear markets recorded, the market fully recovered within one year. It is very difficult to time the bottom precisely but chances are you will be rewarded by staying disciplined and holding on through the downturn and subsequent recovery. It helps to have an allocation that has a mix of risky and safe assets that is suited to your needs and risk tolerance.

Q1 Market Review

In the US, the annual inflation rate reached 9.1% in June. The Federal Reserve raised interest rates by 0.75% in June, more than expected, but also acknowledged that steep interest rate hikes might cause a recession. In Canada, annual inflation hit 8.1% in June, the highest rise in prices in decades. Even with gasoline stripped out, annual inflation was 6.5% in Canada. The Bank of Canada responded by increasing its benchmark lending rate by a full percentage point to 2.5%. Canadian and US stocks fell sharply over the quarter.

In Europe, stocks also continued to fall. Economic ties between Europe, Ukraine and Russia continue to be a concern, especially with respect to energy and food supplies. In June, the Eurozone registered

record high annual inflation of 8.6%, up from 8.1% in May. In Asia, shares also moved lower with ongoing concerns over energy and food prices, supply chain blockages and fears of recession.

In Q2, value stocks continued to outperform growth stocks globally, but small cap stocks underperformed large cap stocks in all regions.

Within the bond markets, investors clearly have become more concerned about inflationary pressures and rising real interest rates, selling off bonds across the spectrum of fixed income and driving bond yields higher.

- The total return on the Canadian stock market was -13.2% for Q2 2022 and -6.9% year to date.

- In the US, the total net return of the S&P500 in Canadian dollar terms was -13.6% for Q2 and -18.8% year to date.

- The total net return for the S&P Global ex-US BMI Index of stocks outside of the US (in Canadian dollar terms) was -11.6% for Q2 and -18.0% year to date.

- The Canadian dollar retreated -3.0% against the US dollar over the quarter and is down -1.6% year to date.

- Total return for Canadian bonds was -5.1% over the quarter and -11.2% year to date. Global and emerging market bonds were also both negative for the quarter and year to date.

Financial Planning topics of interest

If you have a variable mortgage, you will have noticed that your interest rate has increased significantly since the beginning of the year, 2.65% on average according to Ratehub.ca. So far, that might just mean that more of your monthly payment is going towards interest than principle rather than the actual payment going up. Eventually rising interest rates lead to higher monthly payments depending on your specific mortgage terms so it is prudent to anticipate when exactly that might occur and prepare accordingly, whether that means belt-tightening in other areas or increasing your annual spending budget to accommodate the payment increases.

The Canadian prescribed rate which applies to family loans increased to 2% on July 1 and could well rise to 3% as of October 1. If you are thinking of implementing a spousal loan strategy, doing it before that next increase makes sense.

_______________________________________________________________________________

In closing, we encourage investors to not worry too much about market volatility or a looming recession but focus on what you can control. Your best choice for an investment plan is one that fits with your financial needs and risk tolerance, that is globally diversified, and that manages costs and taxes. And of course it is important to maintain discipline through the inevitable dips and swings.