The first three months of the year have brought radical change to our daily lives and to financial markets as a result of the global spread of the new coronavirus, COVID-19. Efforts to contain the spread of the virus have meant that almost all countries have mandated lockdowns to varying degrees which, in most cases, have had a dramatic impact on employment, trade and economic activity in general. As we know the market embeds new information very quickly into prices and as the real impact of the virus becomes clearer, along with the associated fear and uncertainty, risky asset prices around the world have fallen markedly. When investors are fearful and uncertain, they demand higher returns for bearing risk and prices adjust downward as a result.

While markets have recovered somewhat from the March 23 low point, it is difficult to predict what will happen in the near term. Will markets continue to recover? Will the potential for economic damage continue to scare investors and as a result will we revisit lower market prices? These are difficult questions to answer but whatever the outcome in the coming weeks and months, we should still expect to be compensated for bearing risk and if history is a guide, markets do tend to deliver positive returns after sharp declines.

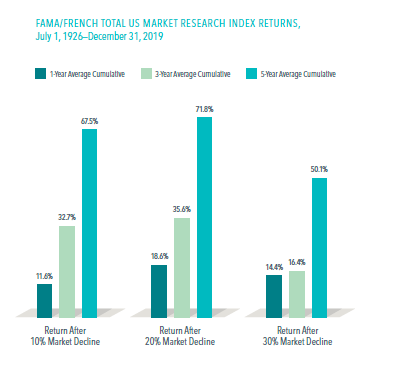

The chart above shows cumulative average returns for a broad US stock market index over one three and five years after market declines of 10%, 20% and 30% going back to 1926. Some recoveries are sharp while some take a little longer and the best way to put yourself in a position to take advantage of the recovery is to stick with your plan, i.e. stay diversified, maintain an allocation between risky and safe assets that suits your risk tolerance and financial goals, and stay disciplined. It is very difficult to call market peaks and bottoms and making trades based on fear or speculation is likely to be counterproductive. Sticking with your plan through market downturns and recoveries, however challenging that may be, is key to having a successful long-term investment experience.

Q4 Market Review

Global stock markets peaked during the third week of February before declining significantly over the next month then recovering somewhat during the last week of March. The decline was one of the swiftest in market history. Governments and central banks around the world reacted quickly to stabilize the financial system and to provide a variety of different support mechanisms to assist individuals and businesses adversely impacted by the situation. Like other central banks, the Bank of Canada reduced its overnight target lending rate to try to maintain liquidity in the banking system. Government bond yields fell and prices rose as investors sought safe havens for their capital. The price of oil collapsed over the quarter as major oil producing countries failed to resolve disputes over production and supply levels, a crisis on its own that was completely overshadowed by the virus. The Canadian dollar lost over 8% of its value compared to the US dollar over the quarter, enhancing returns for Canadian investors with assets denominated in US dollars.

- The total return on the Canadian stock market was -20.9% for Q1 2020.

- In the US, the total net return of the S&P500 in Canadian dollar terms was -12.3% for Q1.

- The total net return for the S&P Global ex-US BMI Index of stocks outside of the US (in Canadian dollar terms) was -17.6% for Q1.

- The Canadian dollar lost -8.5% against the US dollar over the quarter.

- Total return for Canadian bonds was 1.7% over the quarter, beating the performance of Global Developed and Emerging Market bond returns.

Financial Planning topics of interest

As part of the government’s plan to provide help during the crisis they are offering a variety of relief mechanisms aimed at individuals and businesses. For business, there are programs for payroll assistance, to provide emergency wage subsidies, to provide emergency business loans and for tax deferrals. For individuals, the CRA has pushed back the tax filing deadline until June 1st and any payments owed may be deferred until September 1st. There is income support for those impacted directly by the virus and increased funding for those receiving the GST tax credit and Canada Child Benefit. The Canada Emergency Response Benefit (CERB) has been created to try to streamline the process for getting financial assistance to Canadians. For those facing challenges with mortgage payments, the CMHC has provided additional tools to lenders to assist borrowers. The CRA has also temporarily reduced (for 2020) the annual required minimum withdrawal amounts for Registered Retirement Income Funds by 25%.

While we are in the middle of the crisis, it can be very difficult to maintain perspective and remember that market downturns and recoveries are a natural and necessary element of a successful long-term investment experience. The market will recover and we will be rewarded for bearing the risk that is causing the current volatility. In the meantime, it is very important to stay safe and healthy and we wish everyone well during these unusual and difficult times.